Buying a home is one of life's most exciting yet equally stressful moments. You may spend months or years saving up for your down payment, scouting neighborhoods, carrying out due diligence, and negotiating a fair purchase price.

Mortgage closing costs can become an unwanted surprise, stretching your financial position thinner. Read on to understand closing costs and how to eliminate these last-minute financial hurdles.

What Are Mortgage Closing Costs?

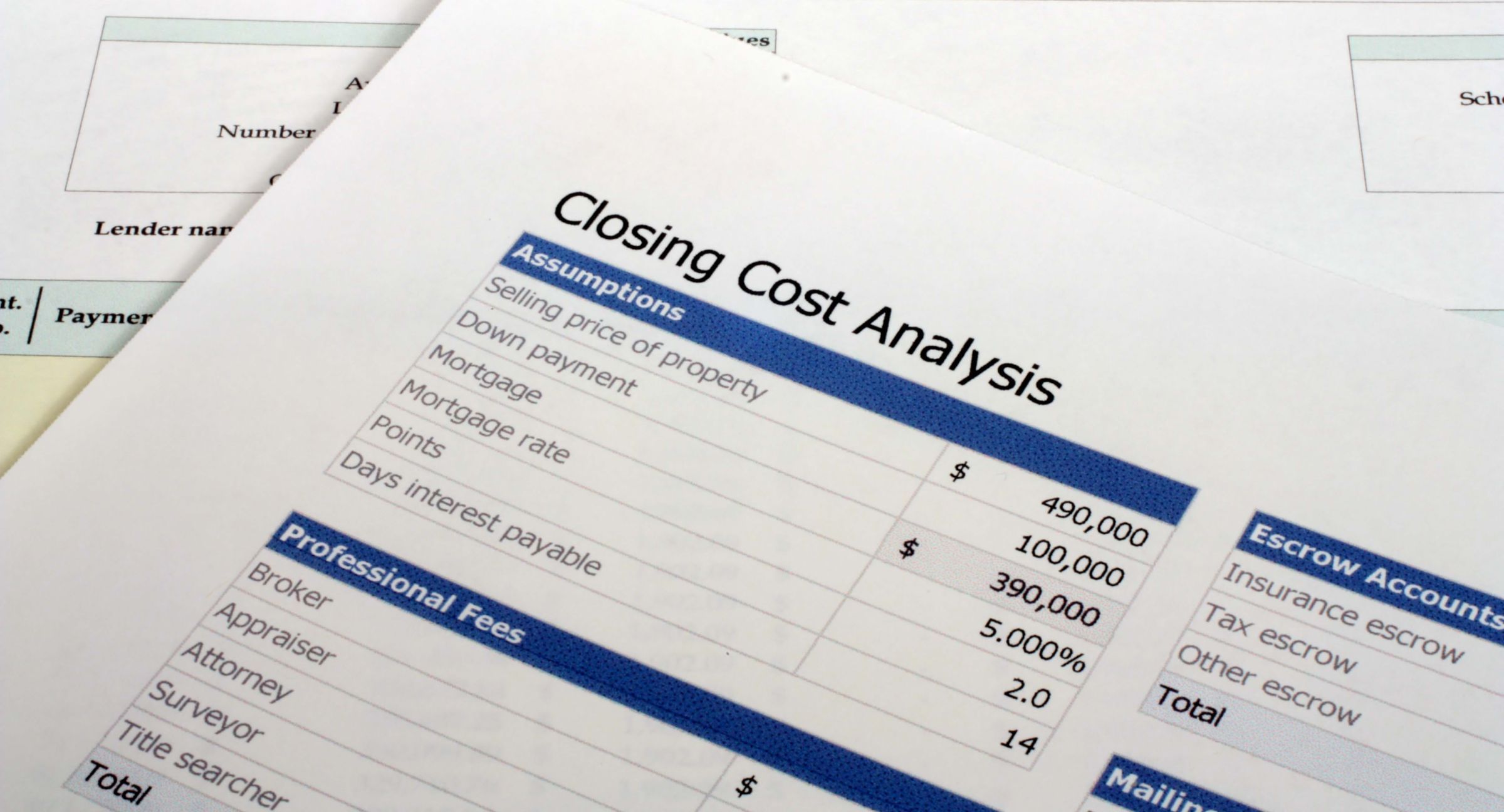

Closing costs are the charges buyers or sellers pay when finalizing the home purchase or property sale. You may pay the charges directly as a buyer or include them in the final loan amount.

Mortgage closing costs are divided into two categories: lender fees, which are paid directly by borrowers, and third-party fees, which come from closing funds.

How to Calculate Your Mortgage Closing Costs

Homebuyers in the US typically pay 3% to 6% of the property value as closing costs. The charges vary significantly, depending on the lender, loan type, and state. You may have to shop around to keep your expenses low.

Lenders can provide a TILA-required lender disclosure — a document that details a good faith estimate of the cost of the loan, including mortgage closing costs. You can also find the exact charges you'll incur on the Closing Disclosure documents, which outline the final expenses of the mortgage loan.

What Makes Up Your Closing Costs?

The closing costs you incur will vary depending on your property type, the location of the home, and the type of loan you pursue. Typical closing expenses that you may encounter include:

Property-Related Fees

The costs cover the expenses to third parties that carry out the home appraisal and prepare the survey reports. You may have to pay for:

- Appraisal charges

- Escrow fees

- HOA annual assessment fees

- Survey fees

- Property taxes

If the home is on a flood plain, you may require a special evaluation report and flood certification from FEMA.

Lender-Related Fees

These expenses cover the cost of processing the loan. They may include charges such as:

- Application fee

- Lenders fee

- Attorney's costs

- Discount points

- Title search fees

- Loan origination fee

The final charges incurred may vary from one lender to the other. Comparing different Good Faith Estimate disclosure forms from various financiers can help lower your mortgage closing costs.

Insurer-Related Costs

Lenders may require homeowners to purchase home coverage before approving the mortgage. Here are a few of the insurance-related closing fees:

- Homeowners' insurance

- VA, USDA, or FHA loan fees

- Lender or owner title insurance

- Mortgage insurance application fee

- Upfront mortgage insurance

You can reduce or eliminate your mortgage closing costs in several ways. Comparing costs from different lenders is a start. You can also check out low-interest loan programs or grants for first-time home buyers. Finally, avoid discount points and mortgage insurance to keep your costs down.

Closing Costs Are a Huge Part of the Home Buying Expenses

You may have to pay substantial closing costs when finalizing the deal. The good news is, many of these fees are negotiable. By shopping around, you could find a lender that will waive or reduce some of their mortgage closing costs.

Contact the expert mortgage advisors at Right Start Mortgage for more information on mortgage closing costs or to start your home-buying process today!